These amounts are set by late-payment legislation and you can only charge the business once for each payment. The amount you’re allowed to charge depends on the amount of debt. These charges are usually referred to as ‘debt recovery costs’ and you can charge them in addition to adding interest to an unpaid invoice. If your customer is a business, you can also choose to charge a fixed sum for the cost of recovering a late payment.

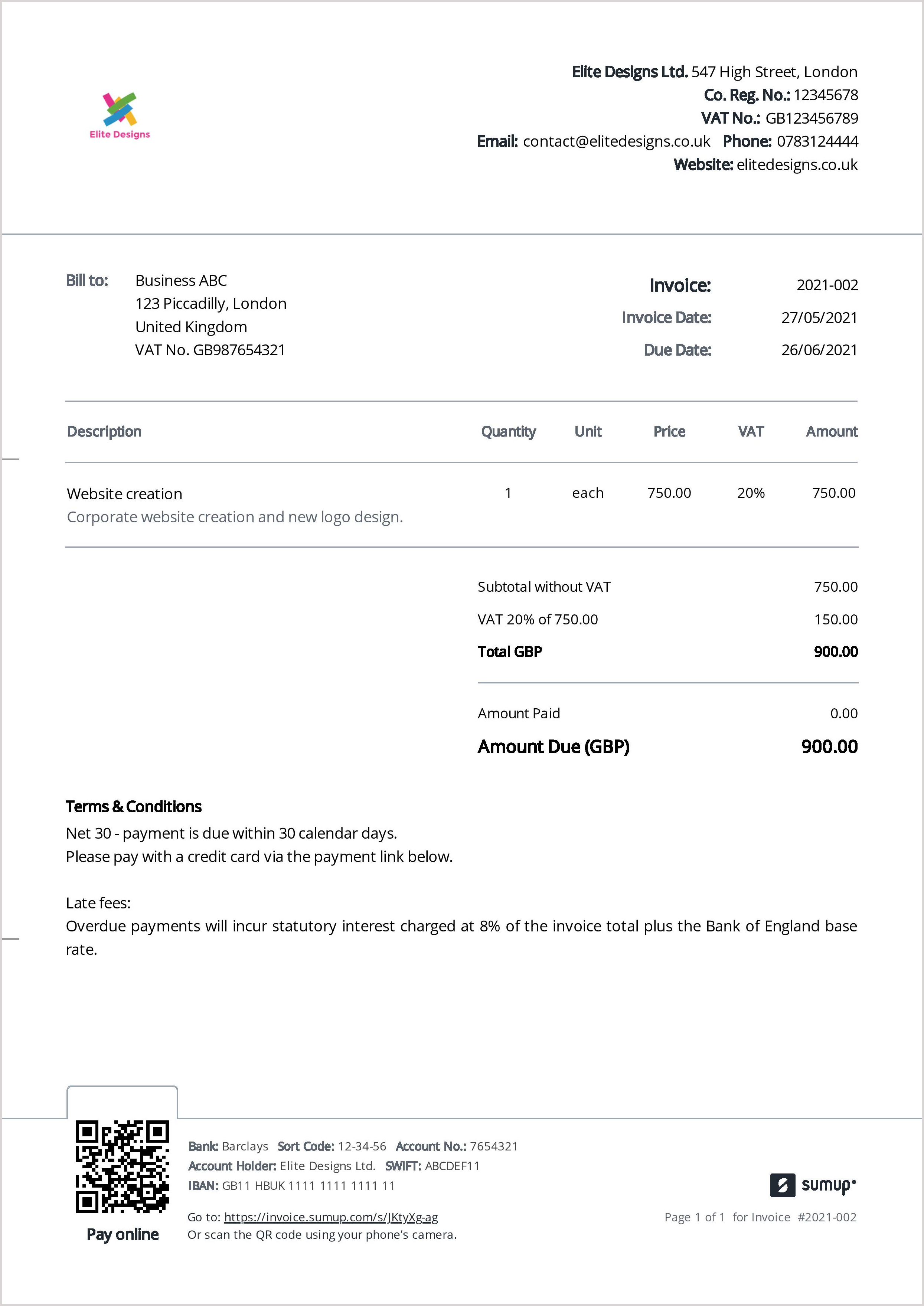

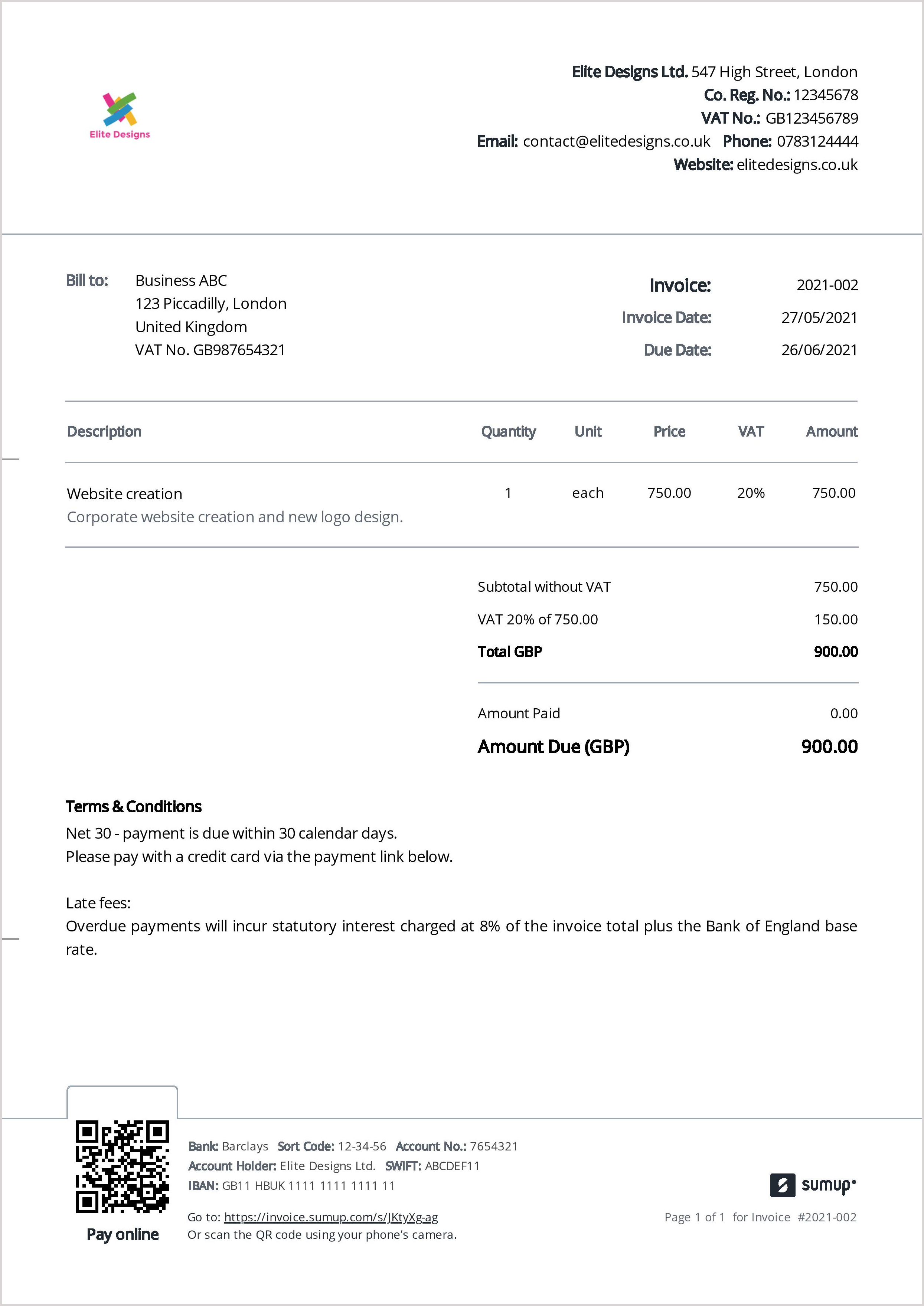

Charging debt recovery costs on late payments If you choose to charge a customer interest on an overdue invoice, you should send a new invoice and include a new line for the interest. For example, if the payment is 100 days late, this would be £22 (100 x £0.22 = £22). Multiply by the number of days by which the payment is late to get your interest total.Divide £81 by 365 to get the daily interest, which in this example is £0.22 a day (81 / 365 = 0.22).Calculate the annual statutory interest, which in this example is £81 (£1,000 x 0.081 = £81).At the time of publication, the BoE base rate is 0.1%.įor example, if a customer owes you £1,000 and the BoE base rate is 0.1%, giving a total interest rate of 8.1%, you can calculate how much interest you can charge in three steps:

#Statutory interest on unpaid invoices plus#

How much can you charge for late payment?įor business-to-business transactions, the statutory rate is 8% plus the Bank of England (BoE) base rate. More information about when a commercial payment becomes late is available on the government's website.

you deliver the goods or provide the service (if this is later). If you do not specify a payment date on your invoice, the payment is defined as being late 30 days after either: 30 days if your customer is a public authority. The payment date must usually be within either: If you specify a payment date on your invoice, the payment will be considered late after this date. However, you cannot charge statutory interest if you’ve agreed on a different rate of interest on the contract. Alternatively, you can charge statutory interest to business customers who pay an invoice late. If your customer is another business (including sole traders), you can specify an interest rate for late payment in your contract with them. The interest rate or any fees you intend to charge for late payment should be clearly indicated to your customers. You can’t charge interest or late-payment fees to individuals (for example, members of the general public) unless you have clearly communicated the intention to do so in your payment terms. If they still haven’t paid and you do decide to apply a charge, there are a few things to consider: Customers who are individuals Mistakes happen - and the customer might be grateful for the reminder! When can you charge for late payment of an invoice?īefore you charge a customer interest on an unpaid invoice, you should get in touch with them via email or give them a quick phone call to let them know that the payment is overdue. But can you charge these customers interest on their unpaid invoices? Here’s a rundown of the rules around charging interest to late-paying customers. If you run a business, it’s likely that you’ve encountered customers who don't pay you on time. 29 September 2021 Can you charge customers for late invoice payments?

0 kommentar(er)

0 kommentar(er)